illinois estate tax return due date

There will be no change in the filing date in case of S-Corporations. Due Date Extended Due Date.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax.

. How to Avoid Estate Tax. A Federal Estate Tax Return or any other form containing the same information is attached whether or not a Federal Estate Tax is due and an Illinois Estate Tax is due. Let A Tax Expert Takes Taxes Off Your Plate.

Learn How EY Can Help. Illinois estate tax regulations Ill. Ad Confidently File Your Return With TurboTax Get The Refund You Deserve Guaranteed.

The Illinois estate tax rate is graduated and goes up to 16. B Installment payments and deferral. C-Corporations will have to file their returns on 15th of the fourth month post completion of their tax year.

For estates over 4 million the tax rate is graduated with the upper level 1004 million and up at 16 percent. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Q1 Jan - Mar April 20.

A fillable form for making payment of the. Join The Millions Who File Smarter. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely.

Q2 Apr - Jun July 20. This extension request should be filed within 9 months of date of death. The extension does not apply to estimated tax payments due on April 15 which are based on either 100 of estimated or 90 of actual liability for.

Q4 Oct - Dec January 20. At this time the executor must also submit copies of appraisals and other ownership documents. The Illinois estate tax exemption for 2015 is 4 million.

The due date for calendar year filers is April 18 2022. We will assume that you are filing your Form IL-1040 for calendar year 2021 unless you indicate a different filing period in the space provided at the top of the return. A Certificate of Discharge is requested.

We will assume that you are filing your Form IL-1040 for calendar year 2021 unless you indicate a different filing period in the space provided at the top of the return. However it is only applied on estates worth more than 4 million. Q3 Jul - Sep October 20.

The Illinois Estate and Generation-Skipping Transfer Tax Act 35 ILCS 4051 et seq may be found on the Illinois General Assemblys website. Estates valued under 4 million do not need to file estate taxes in Illinois. Like federal estate tax returns an Illinois estate tax return is also due nine months after the death of the decedent.

A Federal Estate Tax Return or any other form containing the same information is attached whether or not a Federal Estate Tax is due and an Illinois Estate Tax is due. There are a number of methods that Illinois property owners can use to avoid paying estate taxes. Ad Estate Trust Tax Services.

This documentation is due within nine months of the decedents death although extensions are granted in certain cases. The due date of the estate tax return is nine months after the decedents date of death however the estates. In case of Partnerships and S-Corporations the due date for filing will be 15th of the third month post completion of their tax year.

Taxpayers affected by the severe weather and tornadoes beginning December 10 2021. Estate taxes should be paid within nine months after the death of the loved one. Luckily we have several relatively inexpensive tools that we can use to legally avoid much or all of the estate tax that would otherwise be imposed on your estate.

Payments of estate taxes will no longer be accepted by the County Treasurer of the county in which the decedent died a resident. What about Illinois Estate Tax. 86 2000100 et seq may be found on the Illinois General Assemblys website.

The Illinois transfer tax shall be paid and the Illinois transfer tax return shall be filed on the due date or dates respectively including extensions for paying the federal transfer tax and filing the related federal return. So if you live in the Prairie State and are thinking about estate planning you should learn about this all-important tax law. 97-0732 any and all payments of Illinois estate tax interest and penalties must now be made payable to the Illinois State Treasurer.

If you have additional questions or concerns about estate taxes or your Illinois estate plan in general contact the experienced Illinois estate planning attorneys at Nash Bean Ford Brown LLP by calling 309-944-2188 to schedule your appointment today. An Illinois Inheritance Tax Release may be necessary if a decedent died before. Effective July 1 2012 as a result of the enactment of SB 3802 as PA.

Your Illinois filing period is the same as your federal filing period. When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension.

Filing Tax Returns What Executors Need To Know Fifth Third Bank

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 41 269 Information Returns Processing On Scrips Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Online Cook County Probate Court Records Law Offices Of Jeffrey R Gottlieb Llc

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Annuity Beneficiaries Inheriting An Annuity After Death

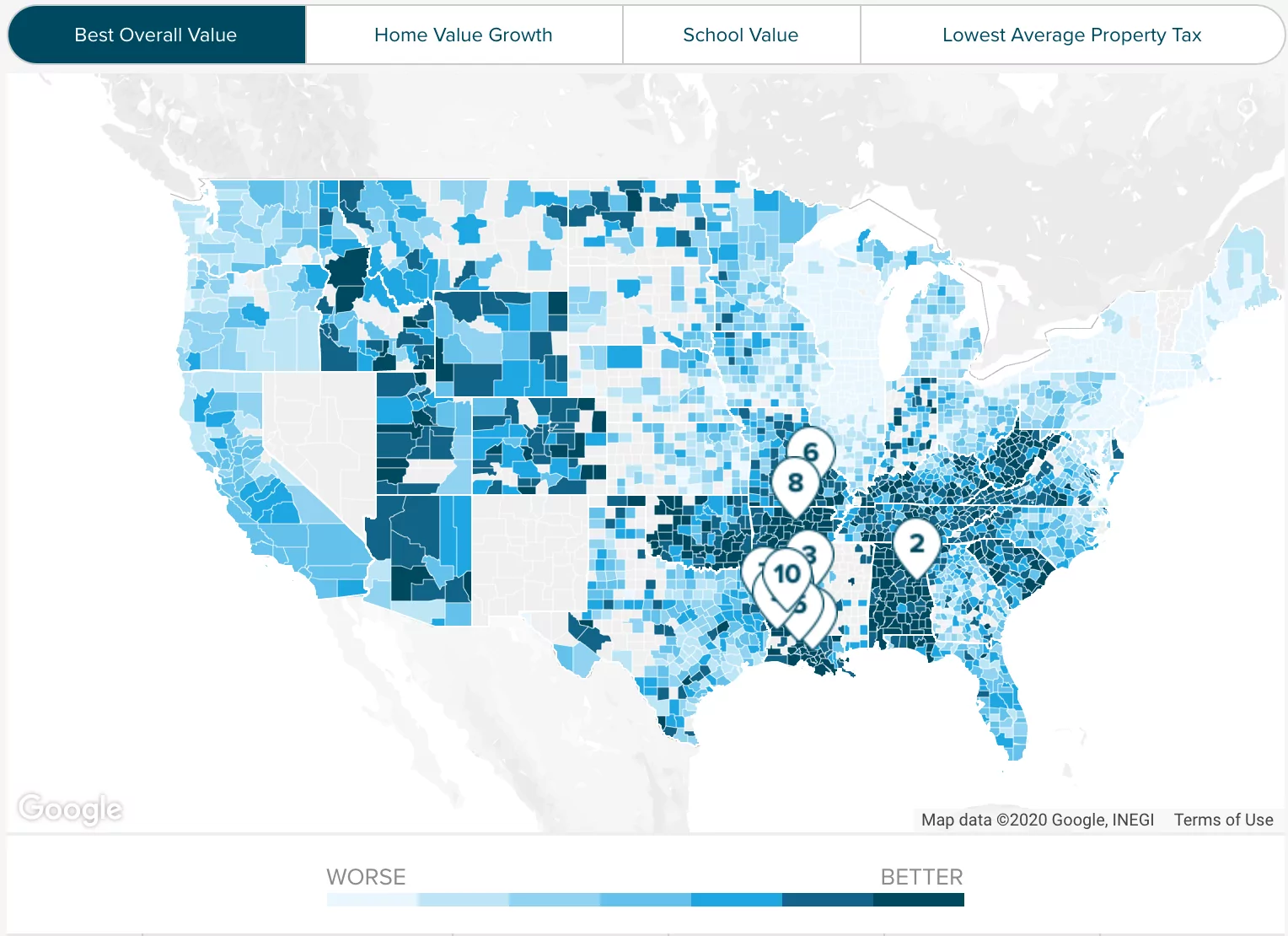

Cook County Il Property Tax Calculator Smartasset

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

New Irs Requirements To Request Estate Closing Letter

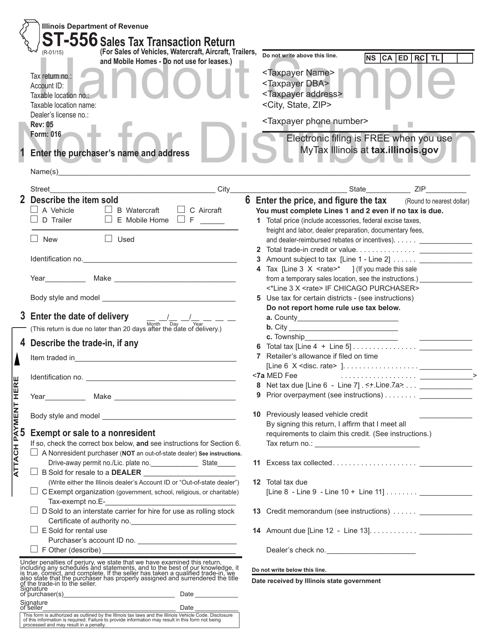

Sample Form St 556 Download Printable Pdf Or Fill Online Sales Tax Transaction Return Illinois Templateroller

State Tax Rates 2022 What Numbers Determine Your Contributions Marca